indiana real estate tax lookup

If you have an account or would like to create one or if you. The information provided in these databases is public record and available through public information requests.

Property Records Information Hamilton County In

County-City Building 227 West Jefferson Blvd Suite 722 South Bend IN 46601 Tax bill information and link to view your tax.

. Co llection of property taxes real estate-personal-mobile home. Enter Last Name First Initial. Property taxes in Indiana are paid to the county where the property is located.

Various Vigo County offices coordinate the assessment and payment of property taxes. May 10 2022 Grant County Treasurer. For the latest property information maps and imagery the public may access Beacons website.

Make and view Tax Payments get current Balance Due. Please direct all questions and form requests to the above agency. Indiana Property Tax Records.

Indiana Gateway Local Tax Finance Dashboard QuickLinksaspx. Enter number and a few letters of the remaining address if the property is. Main Street Crown Point IN 46307 Phone.

Choose from the options below. Taxpayers are entitled to only one Homestead Credit in the State of Indiana. Use this application to.

Once you have entered information click. Payments for property taxes may be made in person or via mail to. Property taxes are due on May 10 and November 10 of each year.

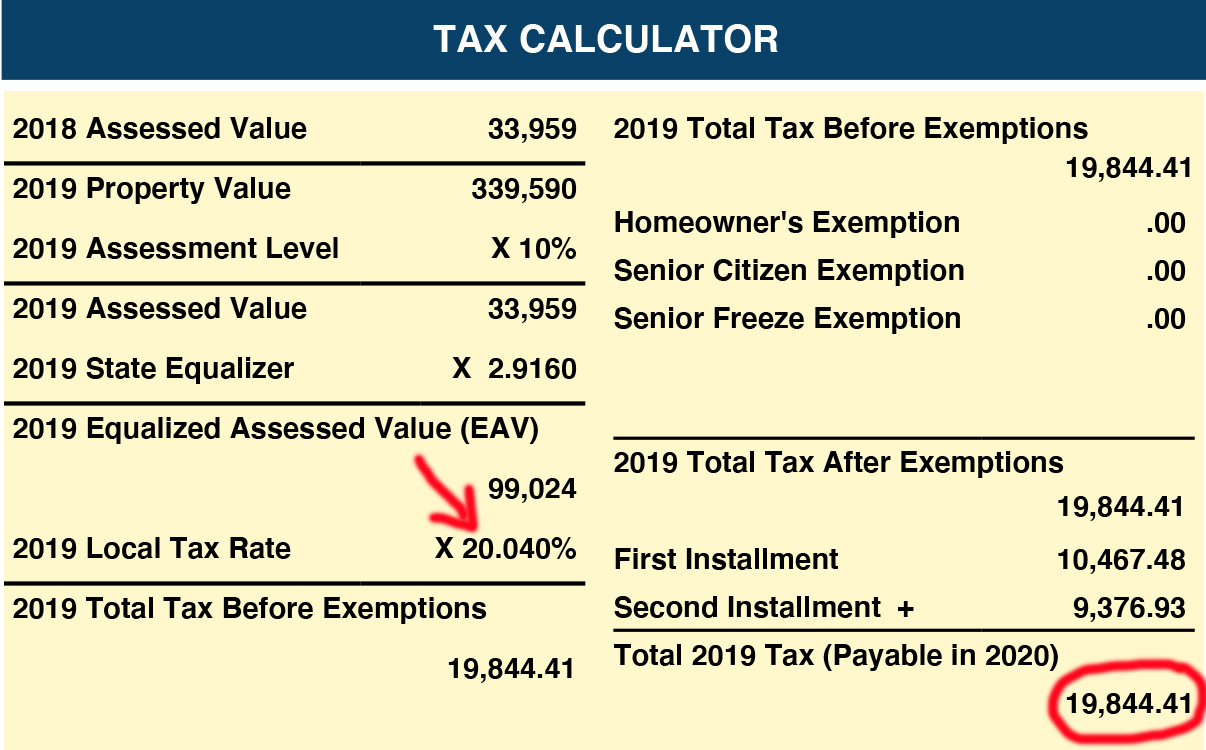

Pay Your Property Taxes. This line will be highlighted in yellow and is the equivalent of the propertys gross assessed value as shown on the Notice of Assessment or Tax Bill. In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad.

Taxpayers may check their TS 1 form under Table 5 to verify they are receiving the Homestead Credit. I ssue mobile home moving permits and verify taxes for alcohol. Payments may also be made via credit card.

This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card. The Department of Local Government Finance has. Friday 800 am 400 pm CST The office of Starke County Treasurer is a statutory office ordained by the State of Indiana for accepting and maintaining all monetary income to the.

Perform a free Indiana public property records search including property appraisals unclaimed property ownership searches lookups tax records titles deeds and liens. 1010 Franklin Ave Room 106. The Property Tax Portal will assist you in finding the most frequently requested information about your property taxes.

As part of our commitment to provide our customers with efficient and convenient service The Treasurers Office now offers tax payments over the Internet using major credit cards and e. Taxes are due and payable in two 2 equal installments on or before May 10 and. Find Allen County residential land records including property ownership deed records mortgages titles tax assessments tax rates valuations more.

This site is tied directly to our local assessment database. Access Property Records and Imagery. Spring due date.

View and print Tax Statements and Comparison Reports. Property Reports and Tax Payments. To search by the following complete only one search box.

November 10 2022 401 S Adams St Suite 229.

Considering Relocating To Jasper Indiana Has Low Property Taxes

Treasurer Wells County Indiana

Indiana Property Tax Calculator Smartasset

How We Got Here From There A Chronology Of Indiana Property Tax Laws

Pay Your Property Taxes Or View Current Tax Bill

Orange County Tax Administration Orange County Nc

Pennsylvania Property Tax H R Block

Treasurer S Office Portage County Wi

Property Taxes By County Interactive Map Tax Foundation

Home Indiana Association Of Realtors

Lake County Indiana Xsoft Engage

Fix Or Sell Illinois High Property Taxes Make Either Tough